Disadvantages Of Bankers Acceptance. A banker's acceptance is an instrument representing a promised future payment by a bank. It helps to eliminate the payment Talking of disadvantages, it has one major one.

In other words, a specific cargo would be financed, typically by the exporter drawing a bill on the importer, and.

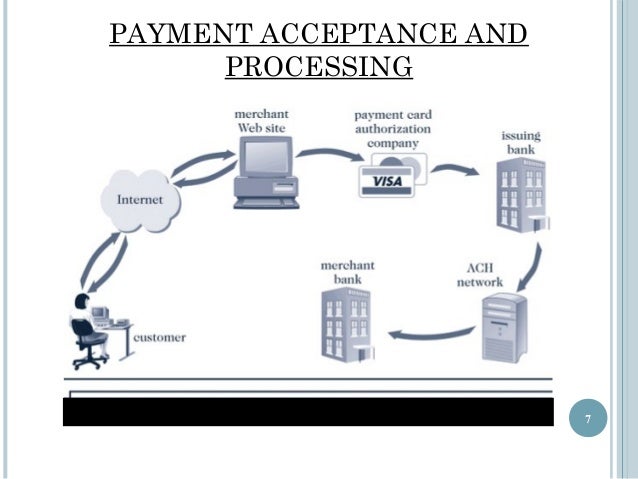

The payment is accepted and guaranteed by the bank as a time draft to be drawn on a deposit.

A banker's acceptance is like a post-dated check, but a bank rather than an account holder guarantees payment. Accepting credit cards also breaks down the geographic barriers of doing business because a business can potentially accept a credit card payment from anyone, anywhere in the world at Credit card acceptance can potentially bring some disadvantages to a business as well. Originally, such bills were all transaction specific.