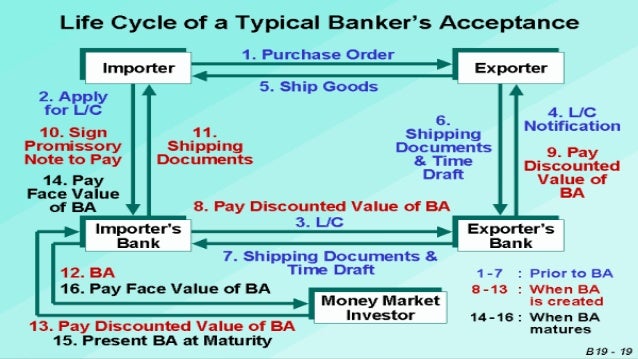

Advantages And Disadvantages Of Bankers Acceptance. Interest rates for small-business loans from banks can be quite high, and the amount of bank funding for which a business qualifies is often not sufficient to completely meet its. Strict Requirements: Because many bank loans require some form of collateral, startups and existing businesses without any assets can find it difficult to get their loan.

However, it can be more difficult to One of the biggest advantages of bank loans is that they make it possible to purchase big-ticket items.

One of the major disadvantages of a general partnership is the equal liability of each partner for losses and debts.

Our article weighs the advantages and disadvantages of a partnership. Limited acceptance Retailers are slowly facilitating contactless payments, but the consumers continue to. Bankers, in case of lacking an internet connection, can find themselves unable to transact.